But when you find out how the trick is actually done it can be a little disappointing, don't you think?

"Oh! ... THAT'S how it's done?"

And it's the same with trading. Once you see how it's done successfully you'll say the same thing.

But like all

magic tricks, if you're trying to figure it

out on your own, without a magician's help,

it takes potentially hundreds of hours of

research to see how it's really done. Most

people probably won't be

able to figure it out without someone's help -

the truth behind the trick is rarely that

obvious.

And neither is

trading success. It's simply not 'obvious' how

to be successful, without help.

The problem is finding that help...

- It's not available on Youtube

- It's not available in any book

- It's not available in a movie

Trading success

is in the minds of those who have devoted

their time, money,

energy and lives to this profession.

This is not a hobby. It's not a game. Successful trading is a business.

Let me share with

you the most important thing that I have

discovered during the 40 years I've been in

the business of trading the

markets.

Give Yourself a Significant Edge

In

order to succeed in the markets you need a significant edge. It has

to be so significant that,

once you find it, no other indicator,

market study or chart pattern, even

comes close to it.

I'm

not talking about a special technical

'indicator' that you use, or the time

of day you trade, or a

candlestick 'pattern' that repeats.

Those could be valuable but they are

not a significant edge.

The

strategy that I use to give myself a significant

edge is going long or

short volatility on major

markets (they have better liquidity),

adjusted for two option "Greeks"

called delta and gamma.

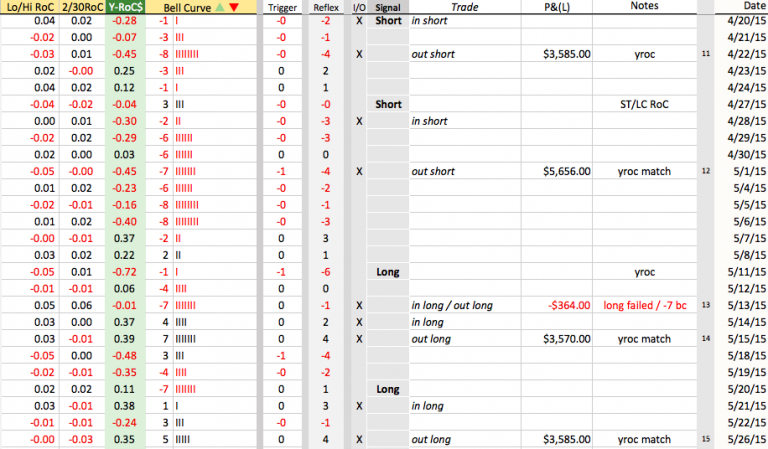

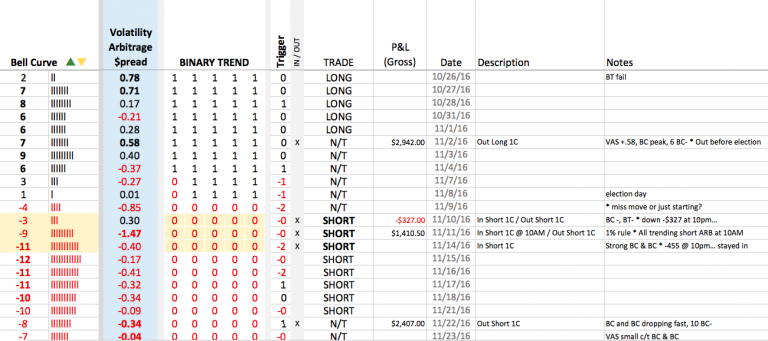

The spreadsheets below

are what I use to measure historic

volatility spreads on the treasuries

market (top) and the major stock

indexes (bottom):

There

are hundreds of ways to

trade the markets and there are

almost as many markets. The

combinations of ways to

trade and markets to

trade are enormous. But

you know what? The reason

most traders fail is, that

they have too

many choices.

Too

many technical indicators to

choose from, too many markets,

too many platforms, too many

gurus, etc. Then there's the

information that comes out

nearly every day - earnings

announcements, economic

releases, world events, news and

disasters, scandals, arrests,

government statistics, etc.

How do you trade

successfully when you're

drowning in information and

trading opportunities?

Pretty soon

you're like a "deer in the headlights"

... stunned by the light of too

much

information and unable to move

out of harms way.

I have made it

my life's work to find the

data, correlations and anomalies

that can give us the edge that

you need to be successful in the

markets. Now, for the first

time, I'm sharing these proven

and exciting results with the

public.

A High Probability of Success

I

probably don't have to tell you

that information overload will

hurt your trading performance -

and it's such a big part of

trading. That's the first

discussion I have with my coaching

clients in one-on-one sessions.

Trading

is not easy and you can easily be

distracted, so to succeed ....

you need a plan -

but very few plans that I've seen

over the last 40 years give you

the opportunity for a high

probability of success.

Since

trading offers almost unlimited

opportunities, you must

set the parameters of what

you'll trade, when you'll trade, how you'll trade

and how long you'll trade. All plans seek to constrain your trading to the markets and to the parameters you set. That's exactly what you want them to do, but many plans don't work. They fail for one simple reason - they rarely work in all market contitions.

But I've got you covered... Two of the three strategies I have developed work well in all market conditions, and the third one works well under special market conditions.

Let me share with you how I came to develop . . .

The Near Risk-less Trading (NRT) System

In 2005 I paid for a seminar from a well-respected option training firm that was supposed to teach ‘advanced’ strategies in option trading. The cost was $5,000 for 2 days of instruction. I received no individual attention and learned nothing of what I consider advanced training. All I learned was Call and Put debit spreads and an "introduction" (very basic) to the Greeks.

I

attended a second smaller seminar

that was about how to trade

futures successfully. It cost me

$7,500.

What they taught was how to use MACD and a few other ‘indicators’ to succeed with futures. It was apparent none of the instructors had any actual experience trading futures contacts with real money. I pressed one of the instructors on this point and sure enough, he admitted he only traded futures using a simulated account (paper money) and never risked any of his own money!

Since then I’ve always been skeptical of what some people call “advanced” option and futures training – especially from those who have never put real money - their own money - on trades.

I

have over 40 years experience

trading with my own money.

I started trading options in 1987 and

stocks in 1974. I've traded stocks,

options, futures, commodities,

bonds and more. In the summer of

1987 they wrote about my trades in

Barron's.

I created the

underground best selling trading

course online, "Trading As A

Business" (sometimes called "Expert Option Trading"),

then created XTR ProTrader and

finally... the Near

Risk-less Trading (NRT)

system.

There are only

two ways to be

successful trading the markets

today:

1) Get

experience. Nothing beats it. Not advanced degrees,

not studying it on your own or

lurking in trading forums, or

looking for the 'secret' on

Youtube. But experience comes at a

price and usually that price is losing

money, maybe even a lot of

money.

2) Get the training and experience from someone who's done it, who's been there and knows what they are talking about. So many people online are "teaching" trading but don't know what they are doing or have never traded real money.

So

you have the choice of getting

experience yourself, OR

learning from the experience

of others.

The first way is expensive and time consuming, the second could shave years off your learning curve.

That's why I started the High Level Options Mentoring program (HLOM).

If there was a Navy Seal training equivalent in trading as a business, this is it!

You'll receive 50X times your money in value and in renewed confidence and a specific trading plan and proprietary set of revolutionary strategies (an edge) that you can use for the rest of your life.

I

call these strategies NRT (Near

Risk-less Trading). You'll see why

if you decide to join our

exclusive membership.

The Highlights of my NRT Strategies

1) Makes money

whether the market goes up or

down.

You do not need to watch

individual stocks, futures,

options or markets. The system I

use creates a unique arbitrage

opportunity that makes

money whether the markets go, up,

down or sideways, after you've

placed the trade.

All

you need to do is update the

spreadsheets that I give give you,

which identify volatility

arbitrage

opportunities

(examples above) - then

watch a couple of charts to time

your entries and exits.

I

have not seen anyone create

opportunities in the market like

this. It's a very different way to

look at trading - in fact, when I

tell other traders about it I tell

them I do not trade the same

market they do. They do not fully

understand what I mean until they

see it for themselves.

2) You can hold

positions with confidence.

You will have the tools you need

to evaluate your position in any

time frame. If you're a short

term trader you will have

much more confidence in your entry

and exits.

If

you have a slightly longer

time frame you'll have the

same confidence. When you create a

position you will know

exactly when to get in and

when to get out using

my strategies.

3) Instead of

reacting to the news you can

be in a position to profit

from the market at any time.

The news can affect your

positions. But you'll have all the

information you need to be

successful. Using our tools you'll

have advanced notice

of major market moves.

4) Using NRT#1

you are protected if

the market goes against you and

you can even make money if it goes

against you significantly.

5) You have the

opportunity for frequent

profits and

the opportunities are endless

using NRT#3

- a unique, low-risk, easy

to enter and exit income method

and in the words of one of our

clients, is"Money

In The Bank"

They are EFFICIENT, SIMPLE, and EASY to manage - 15-30 minutes twice a day does it - and you leave them alone until you're ready to take the profits.

HERE'S THE TRUTH...

In order

for you to make a living trading, you need

to do it as a business and what you will learn

in these HLOM sessions will give you exactly

that knowledge. These strategies were developed

using real money, so they are battle tested to

work in a real trading account.

They

are not theories or "good trading

ideas"... You will learn some

things paper trading, but until

you put your money on the line you

will not learn the depth of a real

trading experience.

I've

traded hundreds of thousands and

millions of dollars over my

lifetime of my own money ... and I

have learned, what few people

learn, about what it really

takes to be successful.

Things

like ...

1) PROTECT

YOUR CAPITAL while still

allowing the opportunity for

substantial profits.

The

biggest problem facing most

traders is how to protect capital

without sacrificing profits. Too

much leverage is risky, too little

means low profits. The method we

use preserves capital while giving

you the opportunity for large

profits.

2) How To Give

yourself plenty of

opportunities for Both Small

and Large Profits, but more

importantly ... Frequent

Profits.

The NRT system has three methods:

- One gives signals once or twice a year.

- The second one generates monthly signals and

- The third one gives signals daily in two different types of trades.

If

you put all three trades together

you have a system that covers all

time frames and market conditions

with exceptional profit

opportunities.

3) How To

Manage Your Risk.

There's no mystery to risk

management but few follow it

because its hard to do. No

one likes to lose money. But in

business and trading, money is

lost all the time. It depends on

you to control the losses. The

truth is, you can decide how much

you will lose.

Most traders think that a trade

will "come back" and so they stay

in a losing trade longer than they

should. The best loss is an early

loss that is taken. We set

specific rules on trades so losses

are minimized.

4) How To

Trade In All Market

Conditions.

To have confidence in a system you

need to understand it completely.

I provide you with every detail of

the system - nothing is hidden -

so that you can trade it with

confidence.

5) How,

with Patience, even a short-term

trade can make you more money

than you think or expect.

When

you have a profit, knowing when to

get out is just as important as

knowing when to take a loss. The

answer is simple. The same rule

for taking an early loss on a

position is used when you have a

profit. For example in a new

trade, if it goes against you by

$200 then you would get out if

that's your stop loss

number.

The

same rule applies if you have a

$1500 profit. If your open profit

drops to $1300 (down $200), you're

out of the trade. Trading is

sometimes just good math ... and

giving yourself an opportunity to

make morethan you lose.

These are the only strategies, after 40+ years of study, trading and experience, that does all the above and I will teach it to you.

Seriously! Once you learn this, you will not want to tell anyone else - except maybe your children.

The High Level Options Mentoring community will be a way for you to get feedback, suggestions, opinions, assistance, ideas and methods on your strategies from me as well as your peers that will be provided in each session.

You’ll be able to ask me directly by email or our online conference room and you can ask me anything.

And if I don’t know

the answer I will find the

answer, but chances are I

will be able to answer any

question you have even if you’re a

pro because I have traded just

about every instrument including

stocks, stock and ETF options,

futures like natural gas, dollar

index, gold, silver, S&P500

mini's, Dow E-mini’s, and more.

THE STRATEGY:

Volatility Arbitrage and Statistical Anomalies

The strategy I

use and teach is called Volatility

Arbitrage (VA).

In addition, I

use Statistical

Anomalies (SA) to

identify unique trading

opportunities.

I call this

combination of strategies,

Near

Riskless Trading, or

simply "NRT".

Don't be intimidated by the terminology. It's actually a simple but very powerful strategy that can be traded in different markets. You will not have difficulty understanding it, and if you do, I'm here to help you with one-on-one sessions if necessary.

If you're not

familiar with VA, you can

get a few of the basic strategies

using options here (NRT#2). There are also

strategies using index

options in combination with

futures contracts (NRT#1),

or using

futures contracts only

(NRT#3).

The

strategy can

take many forms using

various instruments. The way

I use it is different than

most. I use it only on the

most liquid stock indexes -

the DOW (DIA/YM), NASDAQ 100

(QQQ/NQ), S&P500

(SPY/ES) and RUSSELL 2000

(IWM/TF).

I also use it on Treasury futures: 30 Yr (ZB), 10 Yr (ZN), 5 Yr (ZF) and 2 Yr (ZT) maturities.

Then I measure the volatility arbitrage spread, identify statistical anomalies and create positions on highly liquid ETF indexes and/or major futures contracts to profit from these opportunities.

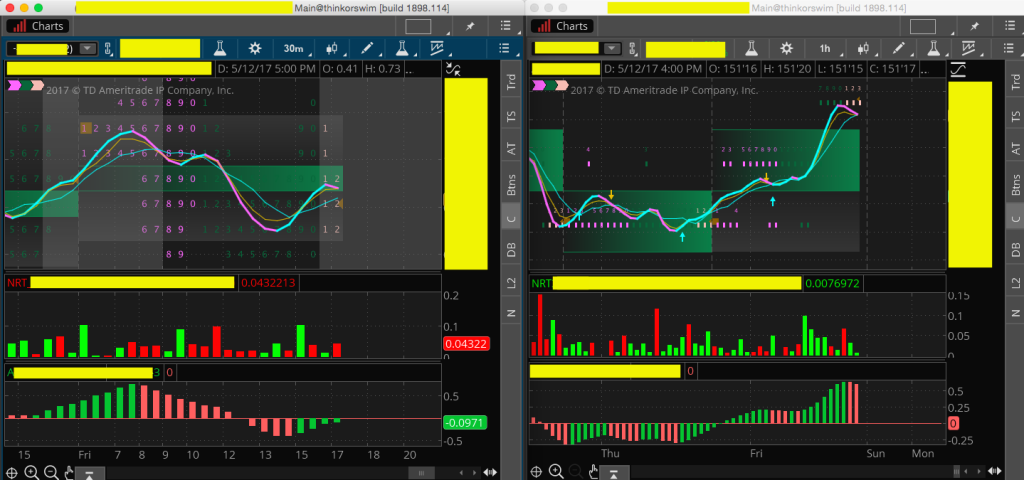

Once we have

identified an opportunity we

use just two charts

to spot entry and exit

points:

These two charts for NRT#3 tell me everything I need to know to enter and exit trades based on the signals I get from the spreadsheets above.

THE MAGIC

The 'magical' part of this strategy is that, even though it sounds really complicated, the signals are clear 'short' or 'long' volatility positions and order entry is super-simple and super-simple to exit.

There's no complicated order entry, no 'legging' into positions, no broker assist required.

Each step of the order process is explained on video with example after example.

In addition, if you ever need any help I'm here. As you can see from the comments made by members, I will do whatever it takes to help you succeed.

Some Questions Answered

a) What is the name of the strategy you are using and teaching in HLOM?

b) Does it require any special software or signal service (paid or free)? Will I be able to trade with OptionNetExplorer or OptionVue?

c) I have downloaded "NRT-4-15-17-trackrecord.pdf" but it is not clear what the first columns mean (e.g. 0 -1 -2; |||||; 1 1 1 0 0) and what mean those letters in the last column - F/B B/F BC VAS, etc

d) Do we profit from theta or gamma (stock move) in this strategy?

e) Are XTR and HLOM different products?

Here's What you Get with the

High Level Options Mentoring (HLOM) program:

1. Recorded

Live Sessions. Access the HLOM live recorded

sessions for

Group 1 and Group

2 (the current

"live' groups).

There are a

total of 24 sessions

for each group.

There's now a

total of 48

in-depth video

sessions

along with the

latest Short

TermTrader

video training,

an "extended

Session" and

recorded "live"

Trading Room

videos.

2. All Live Session Handouts and Downloads. You'll also receive all the handouts, PDF files, Q&A videos, TOS setups and spreadsheets and everything that the live group receives.

3.

NEW! Technical

Analysis Class! This exclusive

class will teach

you how I day

trade and swing

trade the YM, ES

and NQ futures,

how to determine

support and

resistance

points, identify

technical

patters such as

flags, pennants,

head and

shoulder,

diamond,

reversal

patterns,

impulse waves,

hooks and

more... join now

and all recorded

classes will be

yours at no

extra charge! (A

$750 value)

4. Other options trading video courses that

I've created in

the past,

including the Winning

Trade System.

If

you have any

other questions

let me know ...

however...

The

price could

rise and it

will still be

a bargain! But now's

the time to

save... and

with everything

you get it's

easily a

$5,000 to

7,000 value - but you won't pay near that

if you join

today!

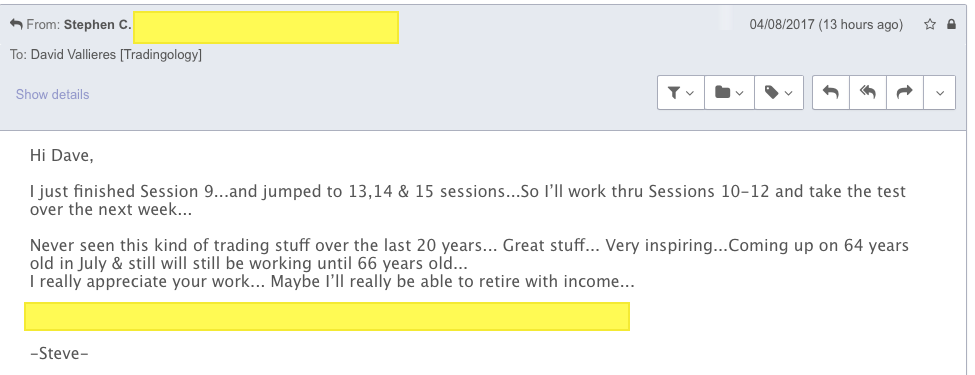

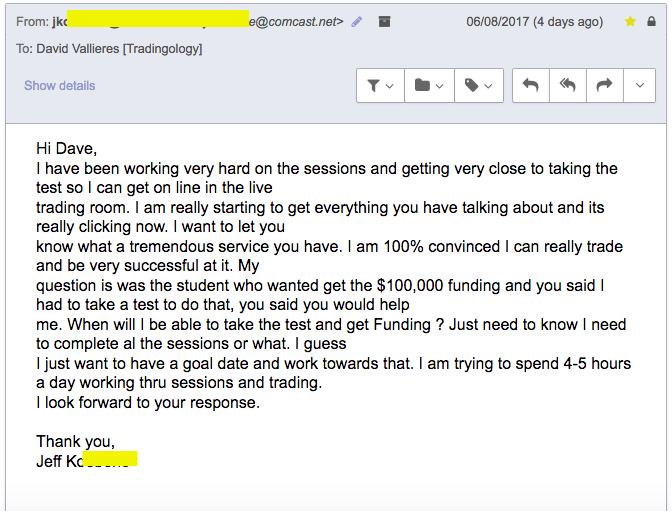

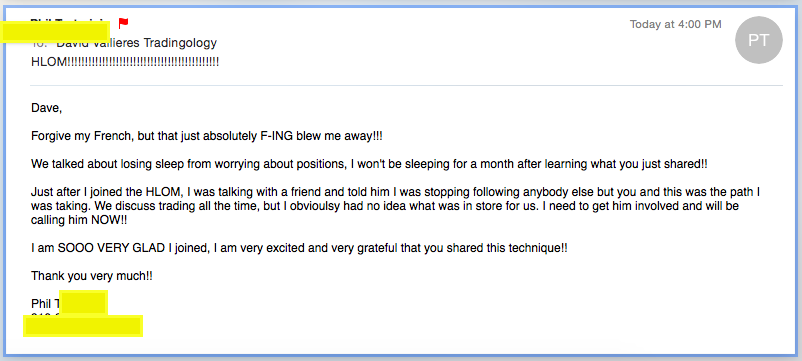

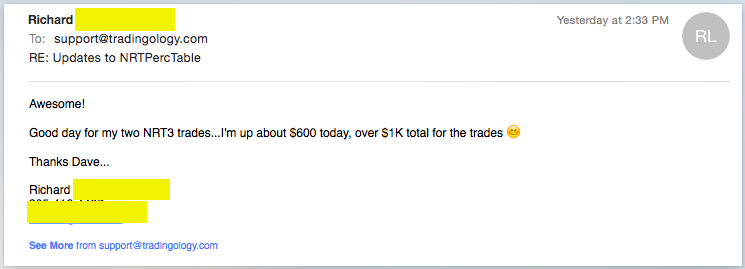

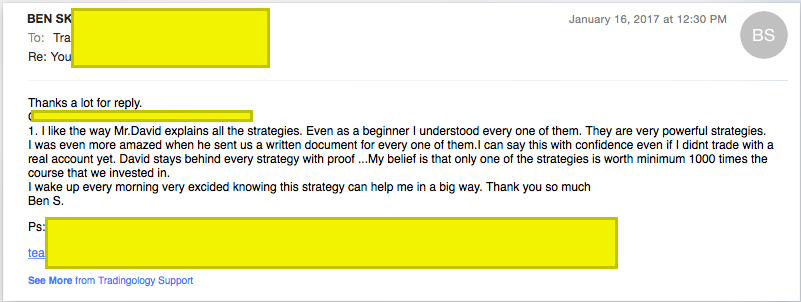

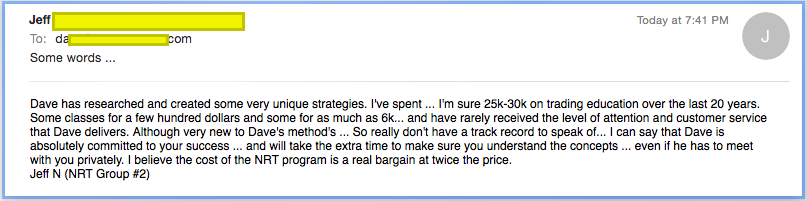

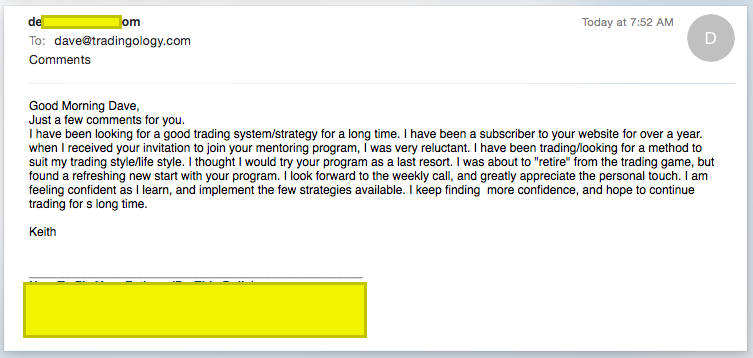

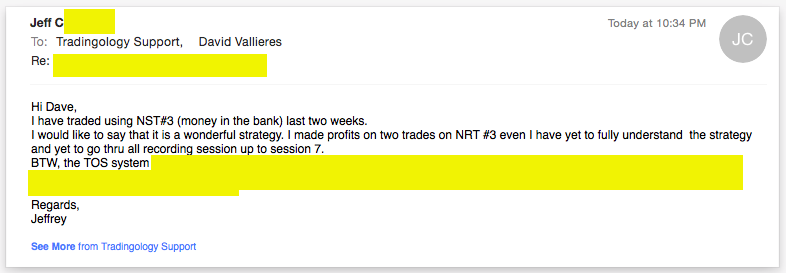

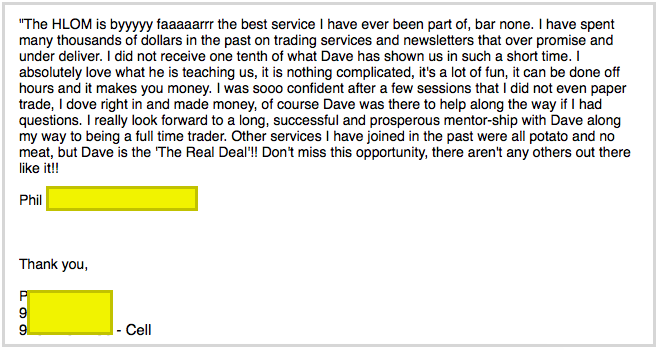

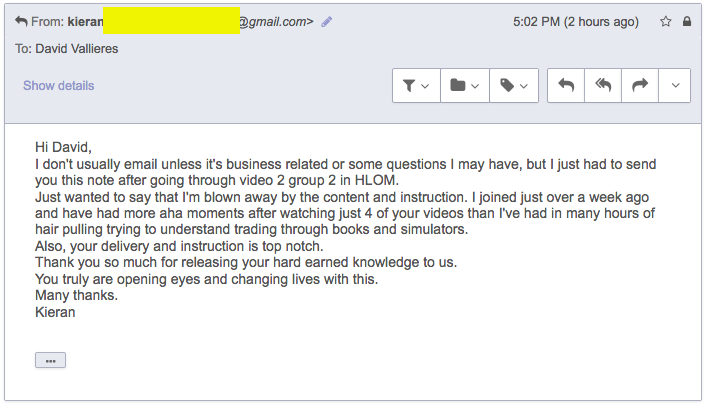

Here's What Our Members Have To Say:

Some unsolicited, unretouched emails from our

members

(some sections blocked for privacy)

Why?

Well ... I don't like to think about it, but I might get hit by a bus one day and that will meant that you're out of luck if you depend on me to give you trading signals. Instead, I want you to have everything you need to succeed - everything.

That means you get to download every video session, every PDF and every Excel spreadsheet. You'll also learn how to update them and use them to trade this system effectively.

No Money To Trade? No Problem.

Trade Other People's Money

There are some private equity firms that allow you to trade other people's money... if you can pass their test.

You can choose to trade from $30,000 up to $250,000 of other people's money.

So

even if you do

not have the

capital

available to

trade, you can

learn my

system, pass

their test and

get a funded

account. This

is how it

works:

Pass

their test.

Get a funded

account...

and

When you make

money

you keep up to

80% of the

profits.

What Are Your Options?

Or learn to trade like a professional and watch your trading change as you learn everything you need to be successful. You can look forward to:

1. Consistent, reliable profits

2. Preservation of capital

3. Trading with confidence

4. Avoiding large loses

5. Developing patience

6. A specific, proven plan and strategy

Here's What You'll Get With Your HLOM Membership

=> 50+ in-depth recorded 'live' session and Bonus videos (to-date) including:

- Recorded "live" HLOM and NRT training sessions.

- Opportunity to post questions on any relevant training video or market commentary.

- "Trading

Room" videos -

where you can

witness

recordings of

live trading

sessions.

- Short Term Trader training and webinar - how to trade with other peoples' money

- Access to a number of advanced level training courses and materials that have been published over the years.

- Updates and notifications - briefings of major market signals, as they occur.

- New

training

material as it

is published.

- Technical analysis classes

=> Group Q&A Sessions (by request).

You Decide. . .

A One Time Payment, OR

A Monthly Subscription Plan

Whichever

option you

choose, you

will receive

access to

all of

the live

recorded

sessions to

watch at your

convenience as

well as all

the handouts

and

spreadsheets.

This is a

great option

for busy

people working

full-time or

odd hours.

If you

continue your

membership,

you'll also

have the

opportunity to

receive the

same great

teaching in

live

weekly

sessions

with me, but

at a discount,

plus all

future

training

material as it

becomes

available.

PLUS

a Lifetime

Subscription

to Trading

Membership

(XTR ProTrader

level) (

$997/year

value), and

more... !

ONE-TIME

LIFETIME

ACCESS PAYMENT

REGULAR PRICE: $2997. DISCOUNT

Price: $997

OR

MONTHLY MEMBERSHIP SUBSCRIPTION

REGULAR PRICE: $297. DISCOUNT

Price: $97

If you'd like a proven system capable of earning you a full-time income from home then take action right now. Get your hands on this program today...

Trade with confidence!

Questions? Submit support ticket: https://expertoptiontrading.com/support

Membership Cancellation Procedure: Click Here

COMMON SENSE DISCLAIMER: Past results are not indicative of future returns. There is a very high degree of risk involved in option and futures trading and it is not suitable for all investors. The information we provide on our site, in emails or any other media is for your entertainment and education purposes only. We cannot and do not give personal financial advice of any kind. Any risks you take while trading are your responsibility.

CFTC

RULE 4.41 –

HYPOTHETICAL

OR SIMULATED

PERFORMANCE

RESULTS SUCH

AS THOSE

DESCRIBED

HEREIN HAVE

CERTAIN

LIMITATIONS.

UNLIKE AN

ACTUAL

PERFORMANCE

RECORD,

SIMULATED

RESULTS DO NOT

REPRESENT

ACTUAL

TRADING. ALSO,

SINCE THE

TRADES HAVE

NOT BEEN

EXECUTED, THE

RESULTS MAY

HAVE

UNDER-OR-OVER

COMPENSATED

FOR THE

IMPACT, IF

ANY, OF

CERTAIN MARKET

FACTORS, SUCH

AS LACK OF

LIQUIDITY,

SIMULATED

TRADING

PROGRAMS IN

GENERAL ARE

ALSO SUBJECT

TO THE FACT

THAT THEY ARE

DESIGNED WITH

THE BENEFIT OF

HINDSIGHT. NO

REPRESENTATION

IS BEING MADE

THAT ANY

ACCOUNT WILL

OR IS LIKELY

TO ACHIEVE

PROFIT OR

LOSSES SIMILAR

TO THOSE

SHOWN.

© ExpertOptionTrading.com All rights reserved

High Level Options Mentoring Home | Privacy Policy | Terms of Use | Contact Us

Yes, I want to make money with stocks,

options and

futures!

Yes, I want to make money with stocks,

options and

futures!